27+ mortgage percent of income

Ad Compare Mortgage Options Calculate Payments. Other rules consider pre-tax versus post-tax.

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Estimate your monthly mortgage payment.

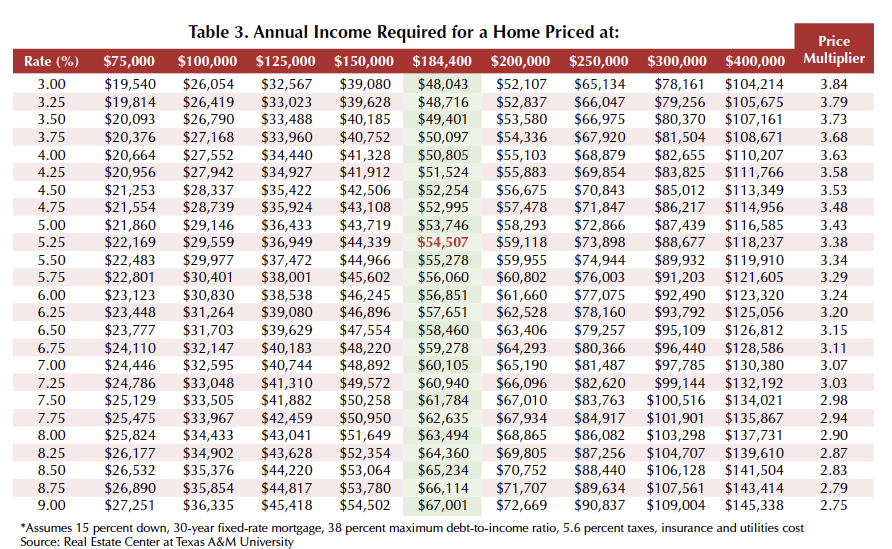

. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Apply Now With Quicken Loans.

Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Ad Compare Mortgage Options Calculate Payments.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Try our mortgage calculator. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Ad See how much house you can afford. Were not including any expenses in estimating the income. Or 45 or less of your after-tax net income.

Were Americas Largest Mortgage Lender. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Compare More Than Just Rates.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Web A mortgage payment now costs 31 of the typical American household income according to Black Knight. Web The Bottom Line.

Find A Lender That Offers Great Service. The 2836 rule is a good benchmark. Compare Offers Side by Side with LendingTree.

Apply Now With Quicken Loans. Web How much of your income should go toward a mortgage. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your mortgage payment. Get an idea of your estimated payments or loan possibilities. Compare More Than Just Rates.

Keep your total monthly debts including your mortgage. Thats up from 24 in December and the highest. Were Americas Largest Mortgage Lender.

Save Real Money Today. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or. No more than 28 of a buyers pretax monthly income should go toward.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you should not spend more. Find A Lender That Offers Great Service.

Web Front-end only includes your housing payment. Web Just over 22 percent of borrowers with conventional mortgages paid private mortgage insurance PMI in 2021 according to the Urban Institute. Begin Your Loan Search Right Here.

Lock Your Mortgage Rate Today. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage in 2022 private renters paid 331 percent or almost one.

So if your gross. Keep your mortgage payment at 28 of your gross monthly income or lower. Lock Your Mortgage Rate Today.

Web The 28 rule which says less than 28 of your monthly income should go to your mortgage is the most popular. Ad Get the Right Housing Loan for Your Needs. Explore Quotes from Top Lenders All in One Place.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Dmv Real Estate Laurel Murphy Real Estate Llc

Mortgage Marketing Materials Graphic Designs Visual Info Design Llc

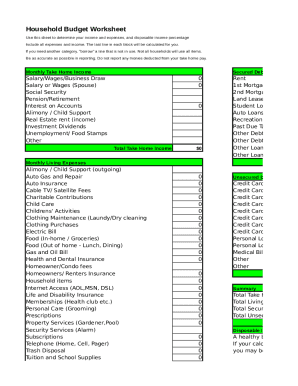

27 Free Editable Personal Budget Templates In Ms Word Doc Pdffiller

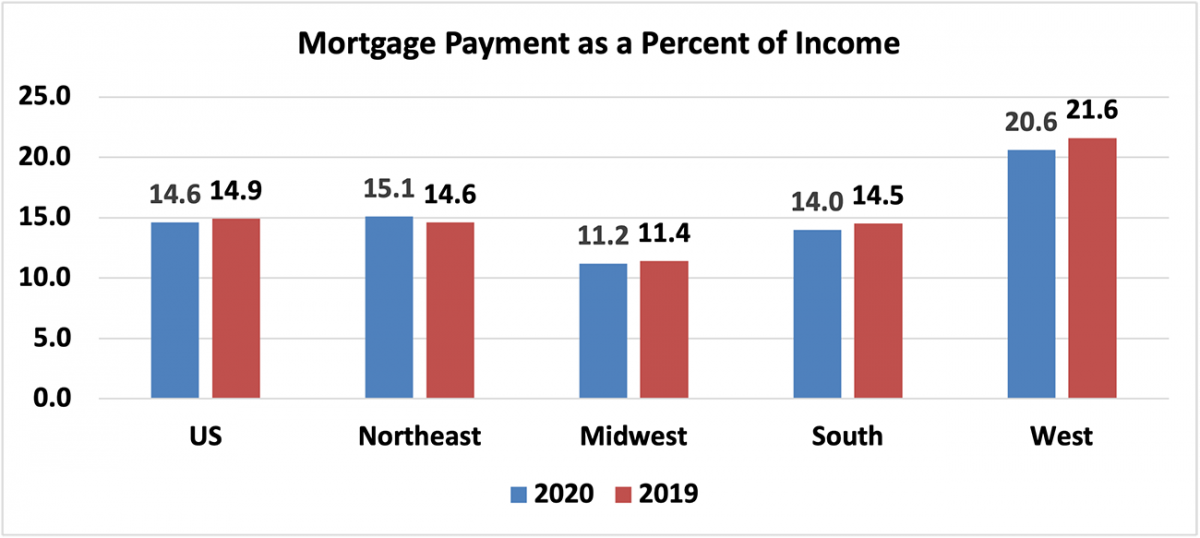

Housing Affordability Improves In December 2020 With Lower Interest Rates

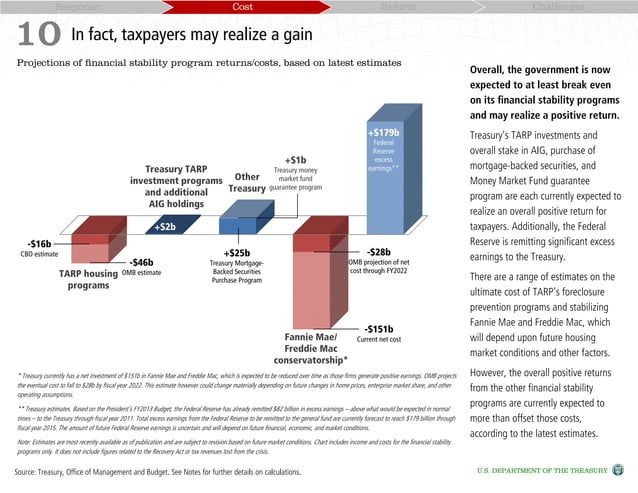

Response Cost Reform Challenges 10

20120413 Financial Crisisresponse Official Document Statistics Abou

The Percentage Of Income Rule For Mortgages Rocket Money

Non Qme Pompano Beach Fl

What Percentage Of Income Should Go To Mortgage

Article Real Estate Center

How I D Invest 250 000 Cash In Today S Bear Market

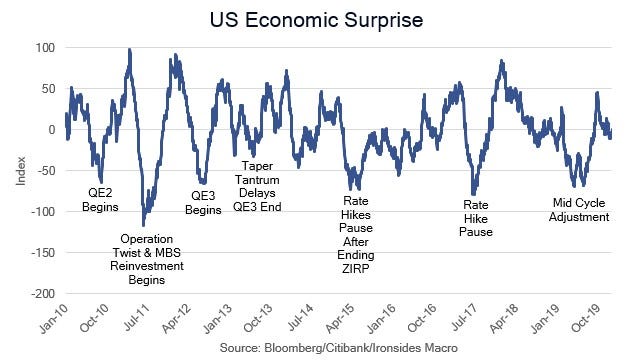

The Third Variable By Barry Knapp

Percentage Of Income To Spend On Your Mortgage Moneytips

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1912 Session Ii Education Thirty Fifth Annual Report Of The

27 Affordable Care Act Statistics And Facts Policy Advice Policy Advice

Money Jan2017 By Egarel07 Issuu